In-house financing allows a retailer to act as the lender by giving the buyer a loan or payment plan directly. The retailer can set their own terms and often keep more of their profits because they don’t need a traditional bank or third-party lender. These terms may make it easier for customers to get loans for big purchases. Many businesses, like car sales, furniture stores, and real estate, offer in-house financing.

What Is In-House Financing?

In-house financing is a type of credit where the seller, like a store or dealer, lends money directly to the customer so they can buy something. This method skips over banks and credit unions. The store often handles the approval process on-site, making the buying process smooth. This happens a lot with expensive items. Industries that often use in-house financing include:

- Retail: Furniture stores, electronics shops, and appliance retailers frequently offer in-house loans at the point of sale.

- Automotive: Car dealerships commonly finance vehicle purchases directly through their own financing divisions.

- Real Estate: Developers or small builders sometimes provide financing to home buyers instead of relying on traditional mortgages.

Benefits of In-House Financing

Offering financing in-house benefits both buyers and sellers. Retailers can increase sales and retain customers, while buyers can pay in more flexible ways. Key benefits include:

Benefits for Customers

- Easier Approval: Retailers may have more flexible credit criteria than banks.

- Flexible Payment Plans: Customers can negotiate terms like lower down payments or longer repayment periods.

- Convenience: Credit is applied on-site, allowing immediate purchases.

Benefits for Businesses

- Increased Sales: More deals and higher-priced item sales.

- Higher Profit Margins: Business keeps interest earnings.

- Customer Loyalty: Builds trust and encourages repeat business.

- Control Over Terms: Customize loan terms to fit business goals.

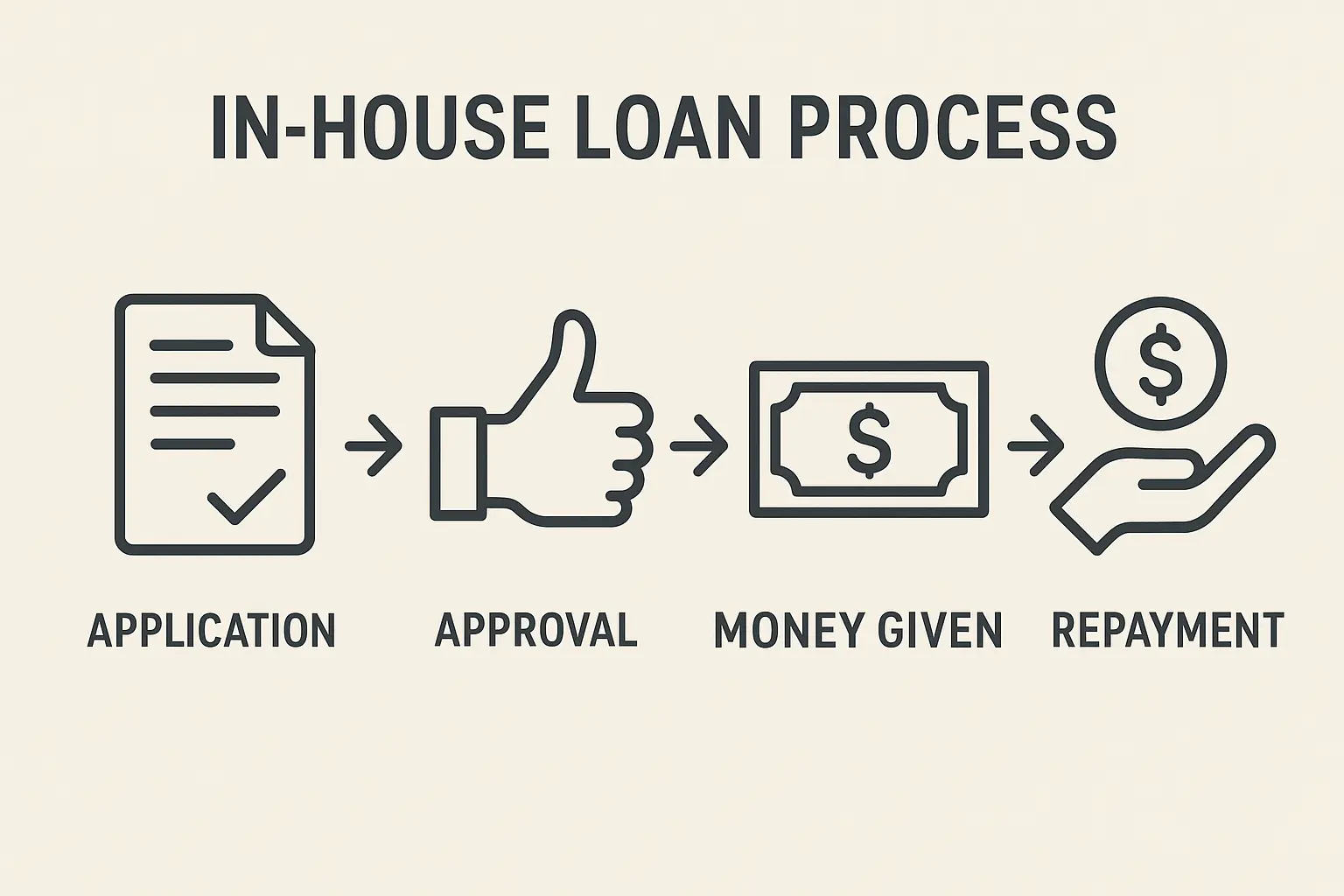

How In-House Financing Works

The process involves several steps at the point of sale:

- The customer applies for financing during purchase, providing personal and financial info.

- The retailer evaluates the application, verifying creditworthiness and setting loan terms.

- If approved, the retailer and customer sign a loan agreement detailing interest rate, term, and payment plan.

- The customer pays the down payment (if required), receives the product, and begins scheduled payments.

Requirements for In-House Financing

- Proof of Income: Pay stubs or bank statements may be required.

- Down Payment: Usually 10–30% of the price.

- Credit Check: Retailers may verify credit history.

- Age and ID: Must be legally able to enter a contract (18+) and provide valid ID.

- Loan Agreement: Signed contract detailing repayment schedule and interest.

Comparison: In-House Financing vs. Traditional Financing

| Feature | In-House Financing | Traditional Financing |

|---|---|---|

| Approval Speed | Fast, often instant or same-day approval | Slower, may take days or weeks |

| Flexibility | Highly flexible, customizable terms | Standardized terms, less negotiation |

| Interest Rates | Often competitive or promotional | Set by lenders, may be higher |

| Customer Experience | Seamless, integrated at point of purchase | Separate application and approval |

| Credit Requirements | More lenient, lower credit scores accepted | Strict, usually good to excellent credit |

| Profit for Retailer | Retailer keeps full profit & interest | Retailer shares profit via fees/commissions |

Risks and Considerations

- Default Risk: Business bears risk if customers miss payments or default.

- Legal Compliance: Must follow lending laws and interest rate regulations.

- Cash Flow Impact: Financing many purchases may delay revenue collection.

- Collection Effort: Retailer tracks payments and manages debt collection if needed.

Image credit: Freepik

Getting Started with In-House Financing

- Assess Demand: Determine if customers need financing and if your margins support it.

- Define Terms: Set interest rates, down payment, and repayment period.

- Ensure Compliance: Research lending laws and get required licenses or permits.

- Set Up Processes: Create internal workflows or use software for applications, approvals, and payments.

- Train Staff: Teach the team to explain the financing process clearly.

- Market the Option: Promote in-house financing through ads and signage.

In-house financing can boost sales, improve customer experience, and give your business a competitive edge with proper planning and management.