Buying expensive items can be tough if you do not have enough money at once. In-house financing lets you take the product home today and pay slowly every month. It is perfect for furniture, electronics, cars, and houses. Customers enjoy fast approvals and simple monthly payments, while shops get more sales and loyal buyers. Just show a valid ID, proof of income, and a small down payment. Pick your product, fill a short form, pay a little now, and enjoy your new item without stress.

Want to understand everything in detail? Read the full article to learn all the tips and tricks!

Buy Now and Pay Later

Buying expensive things can be hard when you do not have enough money at one time.

This is where in house financing helps.

House financing lets you take the product home today and pay for it slowly every month without going to a bank.

What Is House Financing?

In house financing means the shop itself gives you the loan.

You do not borrow money from a bank.

The seller allows you to pay in small monthly payments until the full amount is paid.

This makes buying big items simple and stress-free.

Why Do People Use In-House Financing?

Many people cannot pay the full amount of money in one day.

house financing is popular because it:

- Saves time

- Avoids bank paperwork

- Makes buying easier

It helps families get important things when they need them most.

Where Is In House Financing Commonly Used?

In-house financing is mostly offered for high-price items.

You will often see it at:

- Furniture stores such as beds, sofas, and cupboards

- Electronics shops such as TVs, fridges, and washing machines

- Car dealerships for new and used cars

- Property sellers for houses and land

These items cost a lot, so monthly payments help buyers.

Why Do Shops Offer In House Financing?

Shops want customers to feel comfortable buying.

When payment is easy:

- People buy faster

- More products are sold

- Customers come back again

house financing helps businesses grow and stay competitive.

Benefits of House Financing for Customers

Customers choose house financing because it is simple.

Main benefits include:

- Fast approval

- Easy rules

- Monthly payments

- No bank visits

This option works well for people with limited or average credit history.

Benefits of House Financing for Businesses

Businesses also gain a lot.

They:

- Increase sales

- Earn money through interest

- Build long-term customer trust

- Decide their own payment rules

This gives sellers more control than bank financing.

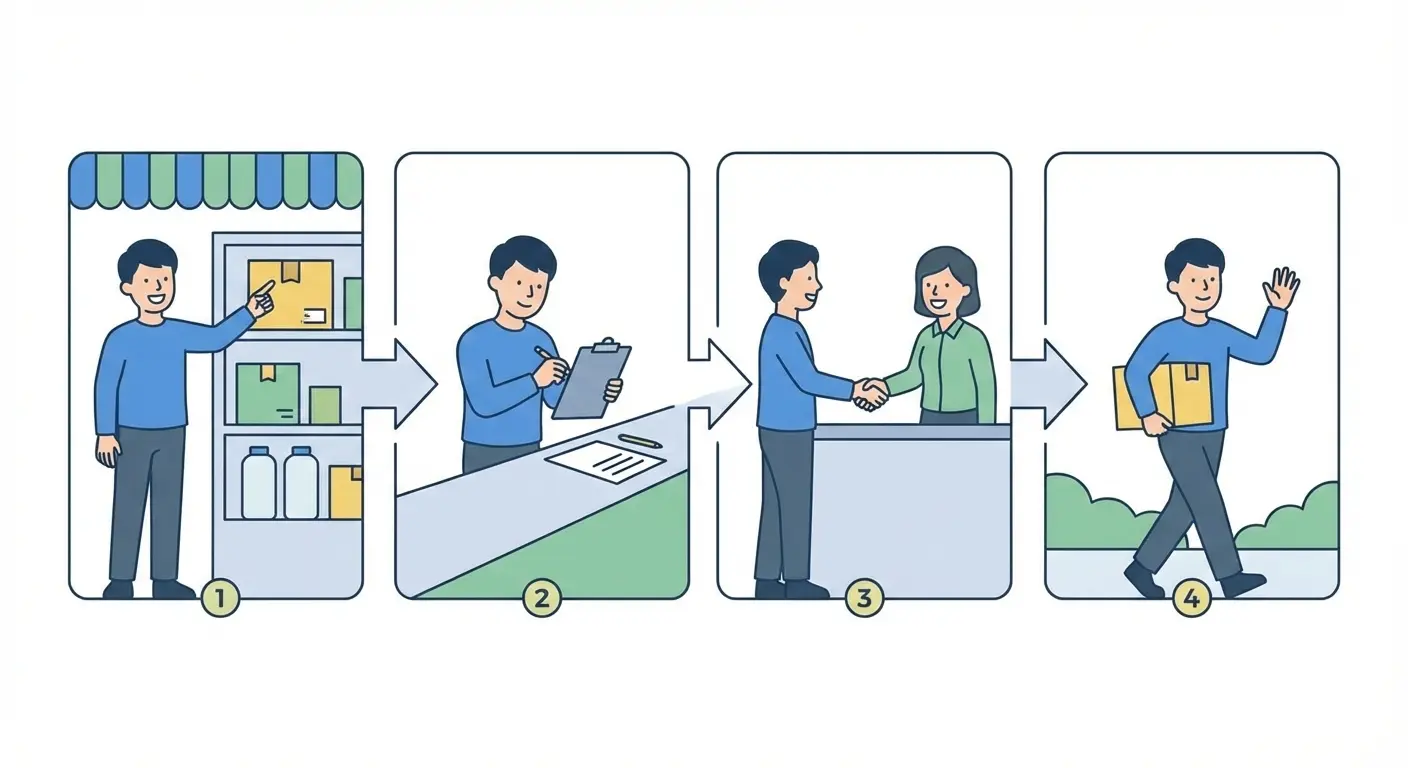

How Does In-House Financing Work?

The process is clear and easy to follow.

- You select the product

- You fill out a short form

- The seller checks basic details

- You agree to the payment terms.

- You pay a small down payment

- You take the item home

- You pay monthly installments

Everything happens at the same place.

What Do You Need to Qualify?

Most sellers ask for only basic requirements.

You usually need:

- Proof of income

- A valid ID

- A down payment between 10 and 30 percent

- A signed agreement

These steps protect both buyer and seller.

house financing vs. bank loans

| Feature | House Financing | Bank Loan |

|---|---|---|

| Approval Time | Same day | Several days |

| Credit Rules | Simple | Strict |

| Application | At the store | At the bank |

| Payment Options | Flexible | Fixed |

| Control | Seller decides | The bank decides |

Does House Financing Improve Credit Score?

In most cases no.

Many sellers do not report payments to credit bureaus.

This means paying on time may not increase your credit score.

Important things to remember:

- Ask if payments are reported

- Pay every installment on time

- Late payments can add extra fees

- The seller can take the item back

Is House Financing the Right Choice?

It is a good option if you:

- Need the item quickly

- Cannot get a bank loan

- Prefer simple monthly payments

A bank loan may be better if you:

- Have a strong credit score

- Want lower interest

- Want to build credit history

Always check the total cost including interest.

Risks You Should Know

For Buyers

- Missing payments can increase costs

- The product can be taken back

For Sellers

- Some buyers may stop paying

Clear rules and written agreements are important.

Final Conclusion

In-house financing is a simple and smart way to buy expensive items without a bank loan.

It offers fast approval, easy payments, and convenience.

Before you sign:

- Read every term carefully

- Know the full cost

- Pay on time

Used wisely in-house financing can make life much easier.

In-house financing is when a shop gives you a loan directly so you can buy now and pay later without going to a bank.

With in-house financing, everything happens at the store. Bank loans require more paperwork and take longer to approve.

Anyone with a steady income and a valid ID can usually apply, even with average credit history.

Most sellers ask for a small down payment, usually between 10 and 30 percent of the price.

Yes, approval is often very fast and may happen the same day.

In most cases, no. Many sellers do not report payments to credit bureaus.

Late fees may apply, and the seller can take the product back.

No, interest rates depend on the seller and the payment agreement.

Yes, it is safe when you read the agreement carefully and make payments on time.

Yes, it is legal as long as the seller follows consumer credit laws.